Planning & Budgeting CloudEnterprise Planning CloudEnterprise Performance Reporting Cloud Account Reconciliation Cloud Tax Reporting Cloud Financial Consolidation & Close Cloud

With Oracle Planning and Budgeting Cloud Service (PBCS), companies can now break free from their reliance on spreadsheets and other outdated processes by elevating their budgeting procedures to the Oracle Cloud.

From fixed-scope packaged solutions to custom implementations, OneGlobe can help you quickly adopt Oracle world-class planning and budgeting solution with a pragmatic deployment approach that best suits your business.

Decision-Oriented Plans with Instant Feedback Loop

Meet the objectives of your business by creating goal-oriented driver-based plans, reports and dashboards.

What-If Modeling and Sandbox

Plan and forecast for complex business what-if scenarios by using ad-hoc scenario modeling, sandbox, and predictive features.

Flexible Workflow and Process Management

Collaborate across the enterprise or with specific groups of users using data-driven, dynamic approvals powered by a state of the art workflow process.

Annotations

Engage in threaded commentary and append documents to add color and substance to your numbers. Expand your numbers with on-the-fly line item detail to further elaborate your plan numbers.

Concurrency in Usage

Define planning models for your specific line of business or create unified models for the company as a whole.

User Interface

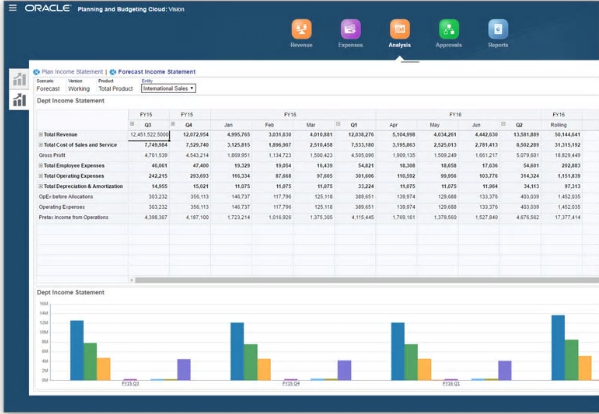

Role-Based, Intuitive User Interface

Plan using a modern, mobile, friendly, intuitive web interface, or use the familiar Excel interface.

Role-Based Navigation Flows

Create navigation flows that are tailored for groups of users based on their usage needs. Sales planners, expense planners, financial analysts, executives etc. each can have their own navigation flows.

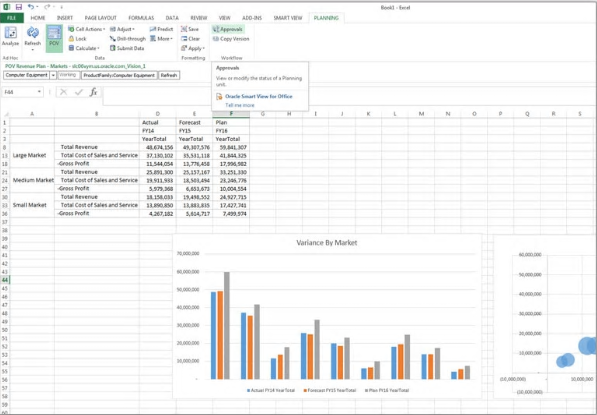

Microsoft Office Interface

Plan and model within the familiar Microsoft Office interface and leverage the built-in integration to Excel, Word, PowerPoint and Outlook. Create input templates within Excel using excel formulas and formats.

Integration

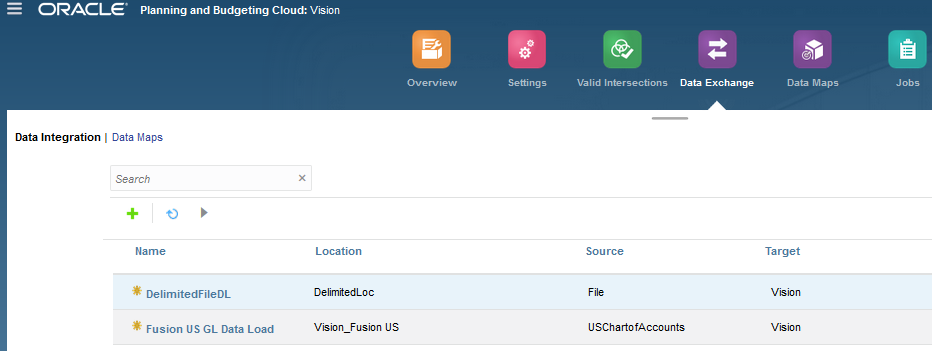

External Integration

Connect to the external cloud, Oracle Cloud, or with on-premises solutions using built-in automation tools or open interface web service capabilities. Import data from various sources including spreadsheets.

Oracle ERP Systems and Hybrid On-Premises Deployment

Take advantage of out-of-the-box integrations with Oracle ERP Cloud or leverage existing on-premises Hyperion investments to deploy Planning Cloud as a hybrid solution.

Oracle’s Enterprise Planning and Budgeting Cloud Service (EPBCS) is based on the market-leading Oracle Hyperion Planning, but built and optimized for the Cloud. EPBCS offers world-class planning, budgeting and forecasting with the simplicity of the Cloud.

From fixed-scope packaged solutions to custom implementations, OneGlobe can help you quickly adopt Oracle world-class planning and budgeting solution with a pragmatic deployment approach that best suits your business.

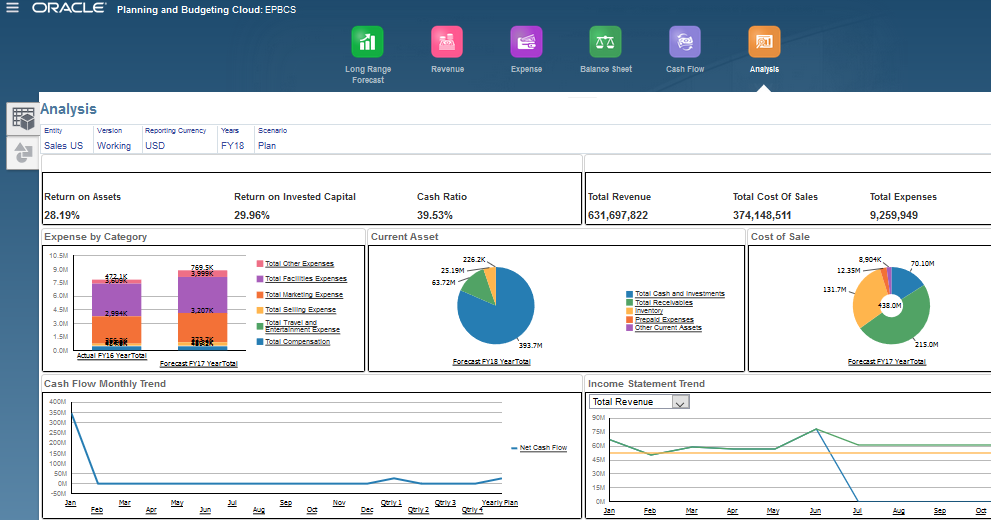

Planning

Get a flexible core planning application that supports goal-oriented plans, multi-dimensional applications, and driver-based rolling forecasts.

Collaboration and Workflow

Leverage flexible workflow and process management, threaded annotation and commentary, and shared document management for collaboration.

Integration

Connect to core source systems such as ERP, as well as other applications and sources including spreadsheets and native databases.

User Experience

Access intuitive, role-based user interface with Web and Excel interface and reports.

Financial Statement Planning

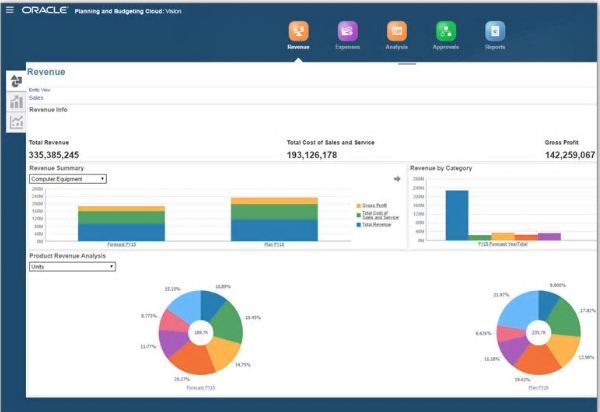

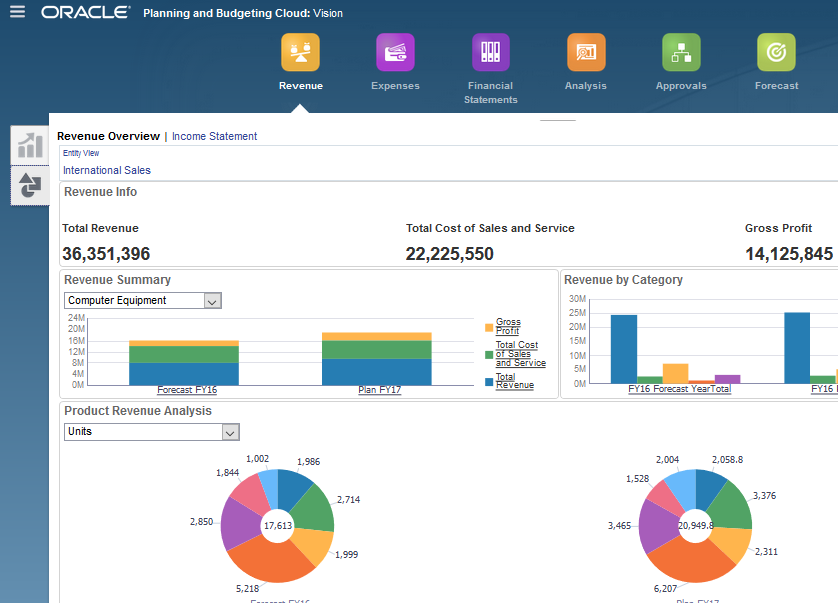

Revenue

Access a configurable framework for revenue/sales and gross margin planning, adding dimensions for the unique drivers of your business.

Expense

Leverage a configurable framework for drivers-based and trends-based planning, using prebuilt, best practice expense drivers. Optional prebuilt integration with workforce and capital processes is available.

Balance Sheet

Integrate balance sheets fully with income statements and cash flow, and configure for industry-specific requirements.

Cash Flow

Focus on cash from operations with fully integrated cash flow. Both direct and indirect cash flow methods are supported.

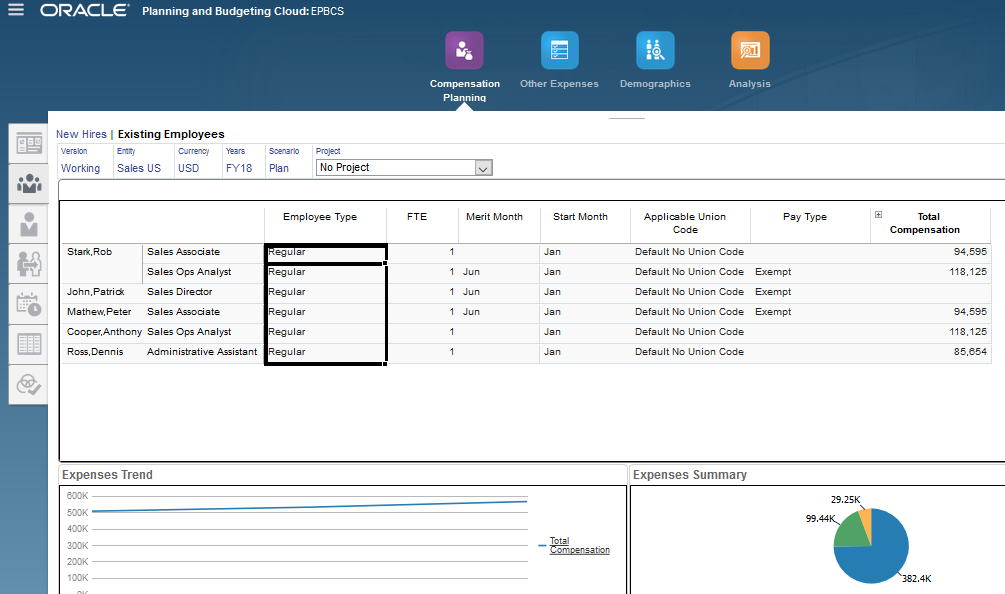

Workforce Planning

Compensation Planning

Plan by employee, by job code, or both using driver-based planning for compensation-related expenses. The Workforce Planning framework allows planning at a level of detail that makes sense for your business and even accommodates large multinational workforces.

Strategic Workforce Planning

Plan the right skills, at the right place, at the right time, and at the right price, aligning your HR strategy with corporate and line-of-business priorities.

Business Wizards

Keep things easy with planning wizards that allow business users to easily maintain even complex employee expense calculations, such as the benefits and tax expense calculations.

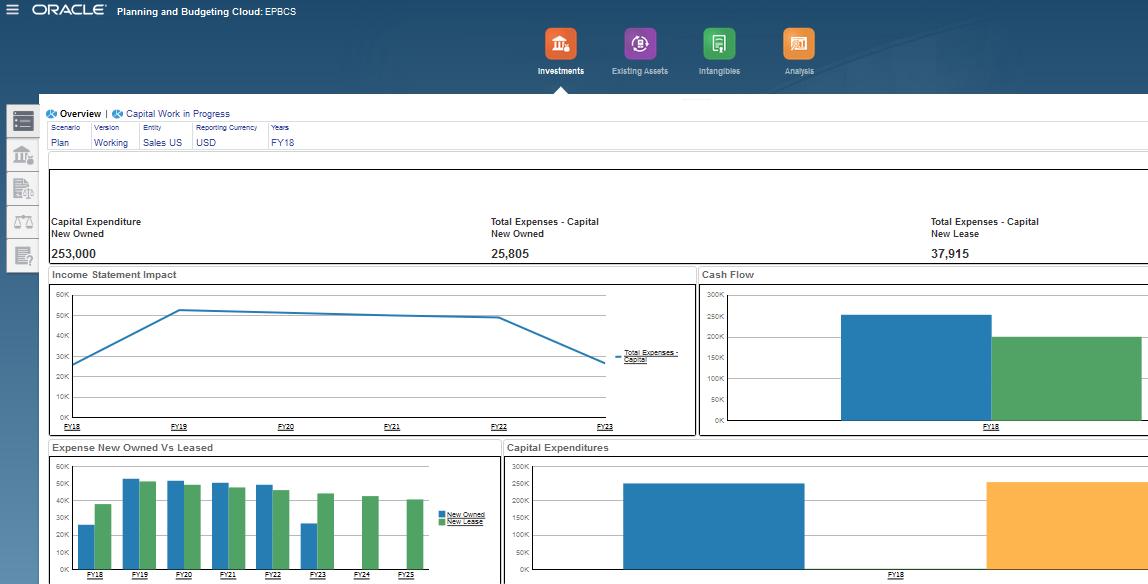

Capital Asset Planning

New Capital Investment

Plan with a framework for new standalone and project-based assets that supports depreciation and amortization calculations using different methods, cash flow planning/funding for investment and leased assets, "buy versus lease" comparisons, as well as asset-related expense planning for full P&L impact.

Manage Existing Assets

Take advantage of planning for asset-related expenses such as repairs and insurance, including automated processes for retirements, transfers, and improvements.

Intangibles

Use planning for new and existing intangibles, including amortization and cash flow planning, and impairments.

Capital Expense Review

Get overall capital expense spend analysis including asset summary reports, actual versus plan variances, as well as the impact on the balance sheet, income statement, and cash flow by asset class and business unit.

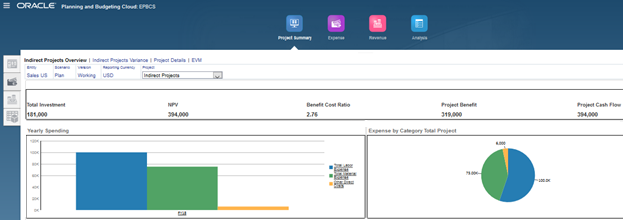

Project Financial Planning

Streamlined Project Planning

Use a planning framework for internal projects within the enterprise—such as IT projects, marketing campaign planning, R&D, and training plans—with driver-based planning for cost pools relating to both short and long-term projects.

Detailed Project Planning

Leverage a planning framework for more complex, project-oriented industries such as construction, engineering, and professional services, with driver-based planning for individual employee and asset-related expenses as well as project revenues.

Project Performance

Get out-of-the-box analysis and reports to review project performance, project revenue, expenses, and cash flows. Real time metrics including NPV, Payback, IRR, and ROI to cover project performance, while EVM measures to track project variances and performance.

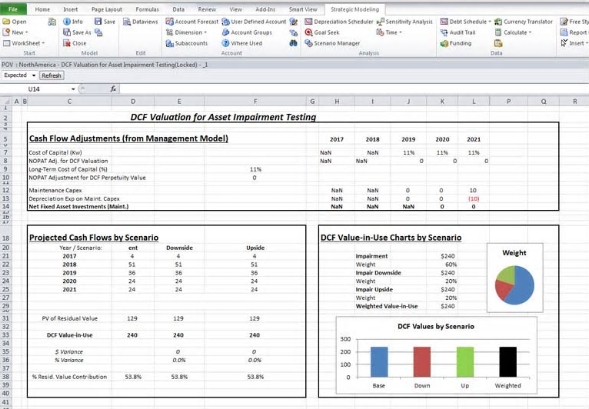

Strategic Modeling

Model for Uncertainty

Get built-in scenario modeling features like goal-seek, iterative calculation logic, instant calculation, and undo capabilities out of the box.

Align Strategy with Plans

Reveal the impact of strategic decisions on the bottom line, balance sheet, cash flow, and shareholder value.

Optimize Capital Structure

Address the iterative nature of funding and the impact of strategies on credit ratings and capital structure.

Prebuilt Financial Tools

Add complex what-if modeling to the financial planning process with built-in tools and logic. No need for writing logic from scratch in spreadsheets

Oracle Enterprise Performance Reporting (EPR) Cloud is a secure, collaborative, and process driven service for defining, authoring, reviewing, and publishing financial, management, and regulatory report packages.

The increasing demand for narrative reporting has implications both internally and externally for companies. Internally, the information increasingly being demanded will necessitate that companies challenge the degree to which they have robust and timely processes capable of collecting, validating, and reporting a wide variety of information on a timely basis, some of which may not have been collated, or reported externally before.

Externally, it will shift the relationship with shareholders and other stakeholders onto an entirely new footing – one in which the transparency and credibility of a company’s strategy and management actions will become a key competitive differentiator.

OneGlobe provides a fixed price service offering in which it helps companies understand the product features and benefits, configure, train implement and support Oracle EPR Cloud.

Account reconciliation is an underappreciated yet critical control to help ensure an organization's financial integrity. Weaknesses and inefficiencies in the reconciliation process often lead to mistakes on the balance sheet and overall inaccuracies in the financial close.

Since the enactment of Sarbanes Oxley (SOX) in 2002 and other rules and regulations that have followed, ensuring the accuracy of account reconciliations has become increasingly important. In the past, if an external auditor found a material error during a review of a company's financial statements, it could still be corrected by the company with an adjusting entry. In most cases, the controller wouldn't have to issue a restatement, nor would the auditor have to report the error.

An efficient, accurate, and timely financial close cycle (beginning with the account reconciliation process) can create a foundation for evaluating business performance, supporting organizational decisions, and satisfying external reporting requirements. Automation of the account reconciliation process is a critical step on the road to achieving "balance sheet integrity" - and ultimately, a timely and efficient financial close.

Oracle Account Reconciliation Cloud software helps companies efficiently manage and improve global account reconciliation by exploiting automation and comprehensively addressing security and risk typically associated with the process.

OneGlobe provides a fixed price service offering in which it helps companies understand the product features and benefits, configure, train, implement and support Oracle Account Reconciliation Cloud.

The digital age is rapidly transforming the relationship between tax authorities and taxpayers. Driven by a desire for more revenue, greater efficiency and improved compliance in an atmosphere of shrinking resources, tax authorities are increasingly relying on digital tax data gathering and analysis — using digital platforms to facilitate real-time or near real-time collection and assessment of taxpayer data.

The move towards tax “digitization” is allowing tax authorities to collect tax data in real time or near real time; they can then use the information to respond quickly and in more targeted ways to perceived compliance risks. Digitization is, in some cases, allowing taxpayer information to be cross-referenced and shared among governments and agencies. Businesses with dated systems or those that are not able to adapt quickly may face increased risk, unexpected costs and compliance challenges to which they are not prepared to respond.

Oracle Tax Reporting Cloud is the modern tax reporting platform to improve processes, connect people, and realize synergy with existing finance systems.

OneGlobe helps companies understand the product features and benefits, configure, train, implement and support Oracle Tax Reporting Cloud.

Key features of Oracle Tax Reporting Cloud include

Today’s finance organizations face multiple priorities that include the oversight of financial transactions, management of enterprise performance, attestation of financial reporting, and timely close and consolidation of financial data. As they grapple with these issues, Chief Financial Officers (CFOs) are always seeking ways to increase the efficiency and timeliness of their financial close and compliance processes.

Oracle Financial Consolidation & Close Cloud dramatically reduces the time and cost to complete a close cycle.

Key features of Oracle Financial Consolidation & Close Cloud Include:

OneGlobe provides a fixed price service offering in which it helps companies understand the product features and benefits, configure, train, implement and support Oracle Financial Consolidation and Close Cloud.

Ready to plan your next project? We'd love to help you get started....!!

.png?width=122&name=Badge-01%20(1).png)

.png?width=2013&name=Badge-01%20(1).png)

Join thousands of subscribers who get Cloud Tips delivered straight to their inbox.

@2017 - OneGlobe LLC.